Alternative Investment Opportunities in Uncertain Times

Our portfolio approach distributes capital across thousands of small-dollar loans, creating natural risk diffusion that traditional investments cannot match.

Portfolio Diversification Benefits

Diversification across thousands of small-dollar loans reduces exposure to any single borrower

Short-term loan cycles of 30-60 days provide enhanced liquidity options

Performance not directly tied to traditional market fluctuations

Supporting fair financial services for traditionally underserved borrowers

About Us

Providing financial opportunities to underserved borrowers while offering investors access to diversified private lending portfolios.

Our Mission

At Dubprime, we bridge the gap between investors seeking portfolio diversification and borrowers needing quick capital. Our mission is to provide financial opportunities to underserved borrowers while offering investors access to private lending markets through a sophisticated micro-diversification approach that spreads capital across numerous independent loans.

Why Choose Dubprime

Structural Risk Mitigation

Our proprietary selection process and portfolio diversification strategy work together to create natural risk diffusion

Alternative Investment

Portfolio diversification insulated from stock market volatility with thousands of independent loans

Social Impact

Help provide financing to borrowers underserved by traditional banks

Transparent Process

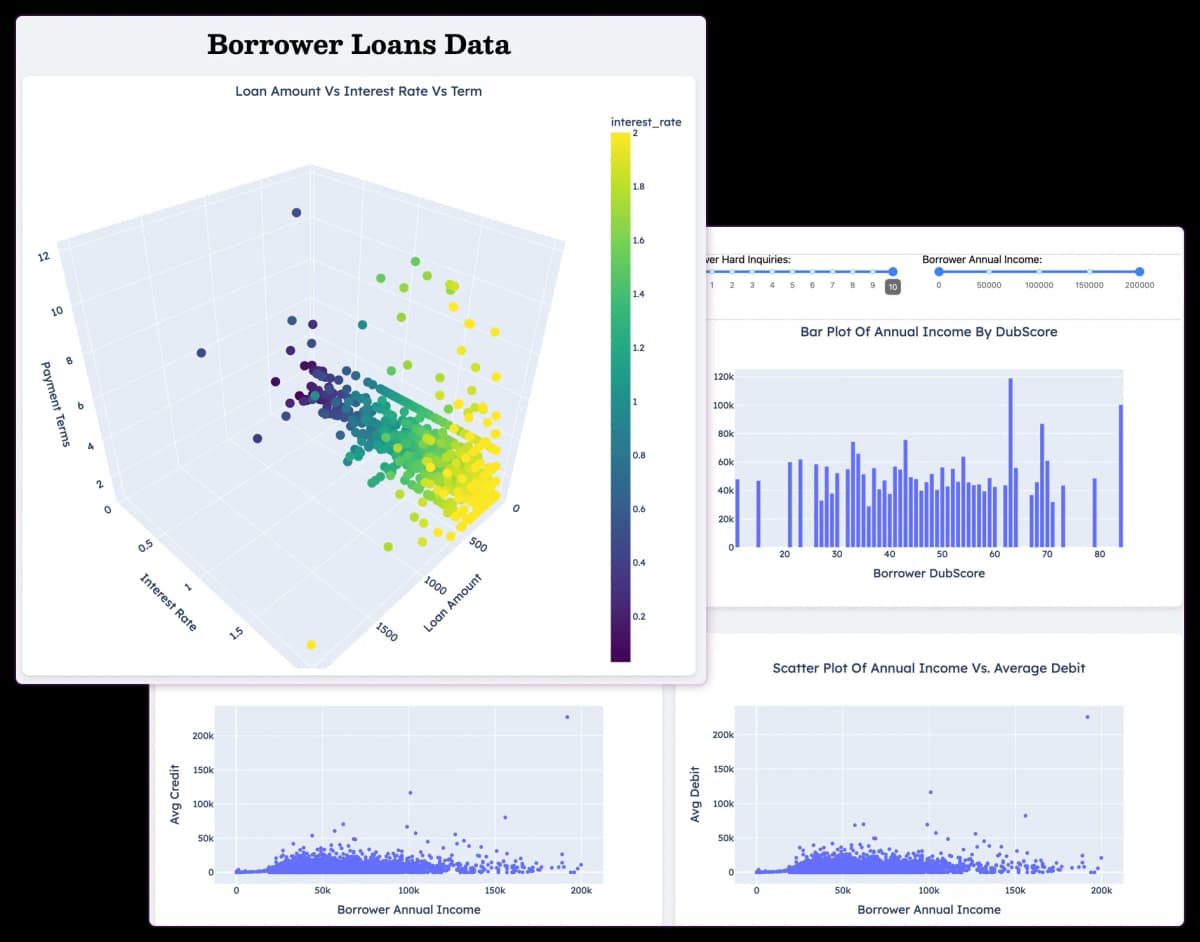

Clear investment structure with comprehensive portfolio analytics

How It Works

Our streamlined process makes investing simple, transparent, and profitable.

Investment Process

Investor capital is used to fund thousands of private loan opportunities to which traditional lenders don't have access.

Loan Selection

Dubprime's proprietary AI algorithms identify optimal loan opportunities and optimize offer strategies to maximize returns.

Rapid Turnaround

Short-term loans with 30-60 day maturity periods create regular capital cycling opportunities and portfolio diversification advantages.

Risk Mitigation Strategy

Our portfolio diversification approach spreads capital across numerous small-dollar loans, significantly reducing exposure to any single borrower and enhancing overall stability.

Benefits

Discover why our investors choose Dubprime for their alternative investment needs.

Diversified Risk

Our portfolio approach distributes capital across thousands of independent small-dollar loans, significantly reducing exposure to any single borrower.

Social Impact

Your investment provides 2x-20x cheaper alternatives to payday loans and other predatory lenders, creating meaningful financial savings for underserved borrowers.

Market Independence

Our loan portfolio is not correlated with stock market performance, offering true portfolio diversification during uncertain economic times.

Short-Term Commitment

Enjoy the flexibility of short investment cycles with 30-60 day maturity periods, allowing for more frequent portfolio rebalancing options.

Frequently Asked Questions

Find answers to common questions about investing with Dubprime

What is Dubprime?

Dubprime is a private lending platform that connects investors with diversified lending opportunities. We provide a way for investors to access carefully vetted private loans through a portfolio approach focused on risk mitigation.

How does Dubprime's risk management work?

We employ a sophisticated diversification strategy that distributes investor capital across thousands of small-dollar, short-term private loans. This approach significantly reduces exposure to any single borrower while maintaining the potential for portfolio stability in varying market conditions.

Where do you source the loans you invest in?

Dubprime has established strategic partnerships with specialized loan origination firms focused on the private lending sector. These relationships give us privileged access to a diverse and continuous pipeline of loan opportunities. We leverage our proprietary technology platform to analyze, underwrite, and manage these loan portfolios, ensuring optimal selection and risk management for our investors.

What is the minimum investment amount?

For a limited time, our minimum investment amount is $5,000. This allows us to maintain efficiency in our operations while providing access to these investment opportunities.

Coming Soon:

Investor Platform

Our dedicated investor platform will provide real-time analytics, performance tracking, and seamless portfolio management - all in one place.

Interested in Learning More?

Book a consultation today! Complete the form below and our investment team will contact you to discuss the opportunities that match your financial goals.